Finding a place to live shouldn’t feel like a game of financial roulette. With rental prices skyrocketing faster than a cat on a hot tin roof, understanding how to calculate rental affordability is crucial. After all, no one wants to end up living in a shoebox while their wallet weeps in the corner.

Table of Contents

ToggleUnderstanding Rental Affordability

Understanding rental affordability involves evaluating what percentage of one’s income can safely be allocated to housing costs. This assessment protects against financial strain and supports healthy living conditions.

Definition of Rental Affordability

Rental affordability refers to the financial capacity to pay for housing without compromising essential needs. Typically, rental affordability guidelines suggest that housing costs should not exceed 30% of gross monthly income. This benchmark helps individuals gauge potential housing options that fit within their budget. Factors influencing rental affordability include location, household income, and current debt obligations. Assessing these aspects allows renters to make informed decisions about suitable living spaces.

Importance of Calculating Rental Affordability

Calculating rental affordability is crucial for maintaining financial health. Accurately determining how much to spend on rent reduces the risk of overextending budgets. Calculations encompass assessing both fixed expenses and variable costs associated with housing. Such measures enable individuals to identify sustainable living arrangements while ensuring necessary resources for other expenses, like food and transportation. When renters employ this calculation, they actively avoid potential housing instability and empower themselves to make informed decisions.

Key Factors in Rental Affordability

Understanding the key factors in rental affordability allows individuals to identify suitable living arrangements within their financial means. Several elements play a significant role in determining manageable rental costs.

Income Considerations

Income plays a crucial role in calculating rental affordability. Renters should assess their gross monthly income before taxes as the foundation for determining an appropriate budget. Financial experts often recommend allocating a maximum of 30% of that income toward housing costs. For example, if a person earns $4,000 monthly, rental costs should ideally remain below $1,200. Evaluating additional sources of income, such as side jobs or investments, can also broaden affordability options. Ultimately, understanding one’s income will guide effective budgeting and decision-making in the rental process.

Housing Market Trends

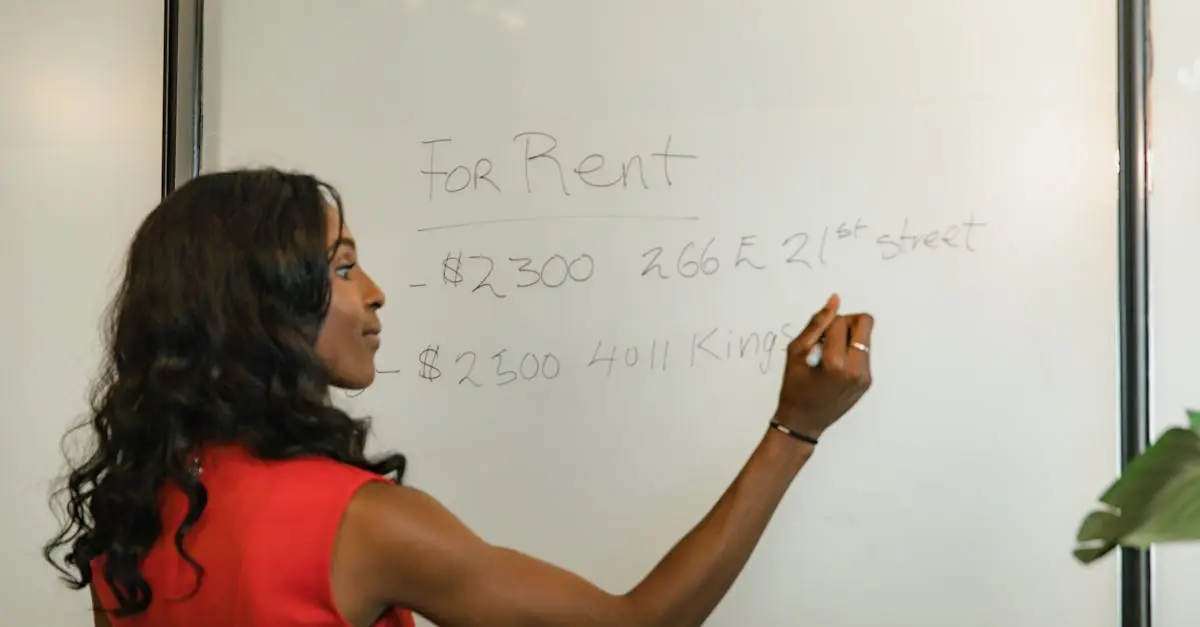

Housing market trends significantly impact rental affordability. Rent prices fluctuate based on demand, location, and economic conditions. In a competitive market, rental prices may exceed the recommended 30% threshold, forcing renters to reconsider their options. Tracking local market trends provides insights into average rental prices for various neighborhoods. For instance, urban areas may showcase higher costs than suburban regions. Observing seasonal changes, like fluctuating prices during peak moving seasons, can also aid in finding more affordable options. Overall, being aware of housing market dynamics will enhance the ability to make informed renting decisions.

How to Calculate Rental Affordability

Calculating rental affordability requires understanding key metrics and personal financial situations. Renters benefit from knowing guidelines and methods to ensure their housing costs remain within a manageable range.

The 30% Rule

The 30% rule suggests individuals allocate no more than 30% of their gross monthly income to housing costs. This guideline offers a simple benchmark for assessing affordability. For example, someone earning $4,000 monthly should aim for rent around $1,200. Exceeding this limit may lead to financial strain. Renters should also consider additional expenses like utilities and maintenance, which can further impact overall affordability. Regularly calculating these figures allows for proactive financial management.

Customizing Your Calculation

Customizing the calculation of rental affordability involves considering unique financial circumstances. Each person’s situation varies based on income, debts, and lifestyle choices. Renters may want to factor in additional expenses like student loans or credit card bills when assessing affordability. By tracking total monthly obligations, a clearer picture of available disposable income emerges. Renters may use online calculators to simplify this process and tailor their assessments to specific needs. Analyzing both income and expenses ensures better decision-making in finding suitable housing options.

Tools and Resources for Calculation

Several tools and resources exist to help renters calculate affordability accurately. Utilizing these can simplify the process and provide clearer insights into financial capabilities.

Online Calculators

Online calculators serve as valuable tools for determining rental affordability. Many websites offer calculators specifically designed to assess housing costs against income. Users input their gross monthly income and current expenses to see if they stay within the recommended 30% allocation for housing. These calculators often account for additional costs like utilities and maintenance fees. Renters benefit from immediate feedback, enabling quick adjustments to their budgets. Additionally, some calculators provide insights into local market trends.

Budgeting Apps

Budgeting apps support renters in tracking overall spending and managing finances effectively. Many apps allow users to categorize expenses, including rent, utilities, and other necessities. By setting budgets within these applications, individuals gain a clearer view of their financial situations. Alerts and reminders help users stay accountable and proactive in managing their rental expenses. Various options are available, allowing users to choose apps that fit personal preferences and needs. As app usage increases, renters find additional tools for fostering financial stability and informed housing decisions.

Calculating rental affordability is crucial for anyone navigating the housing market. By adhering to the 30% rule and considering personal financial circumstances, renters can make informed decisions that align with their budgets. Utilizing online calculators and budgeting apps can simplify this process and help track overall expenses.

Understanding local market trends and factoring in additional costs ensures that renters remain financially stable while securing suitable living arrangements. Ultimately, a thoughtful approach to rental affordability can lead to better housing choices and improved financial health.